India needs to strengthen the independence of regulatory institutions, increase its tax base, roll back a hike in import tariff and come up with an out-of-court restructuring process for stressed assets, former RBI governor Raghuram Rajan and IMF chief economist Gita Gopinath along with other top economists have said in a paper released on Friday.

Releasing the report, titled “An Economic Strategy for India” by around 13 economists, Rajan said, “As we grow and become a more developed economy, we have to think about institutions that can help guide our growth — that certainly emphasises the strength of the institutions and the operational independence under the overall guiding framework.”

The comments become significant in the light of the current tussle between the RBI and the government with the latter trying to get the central bank to fork out part of its reserves and relax norms for weak banks.

Rajan also took on the issue of farm loan waiver, a politically-charged topic, stating: “Certainly, there is a reason to think about farmers’ distress, but the question that flows is whether loan waiver is the only solution. Does it reach the farmers who actually need it?”

The former RBI governor said a debate on fiscal transfers was needed, adding “farm loan waivers will create fiscal issues for states”.

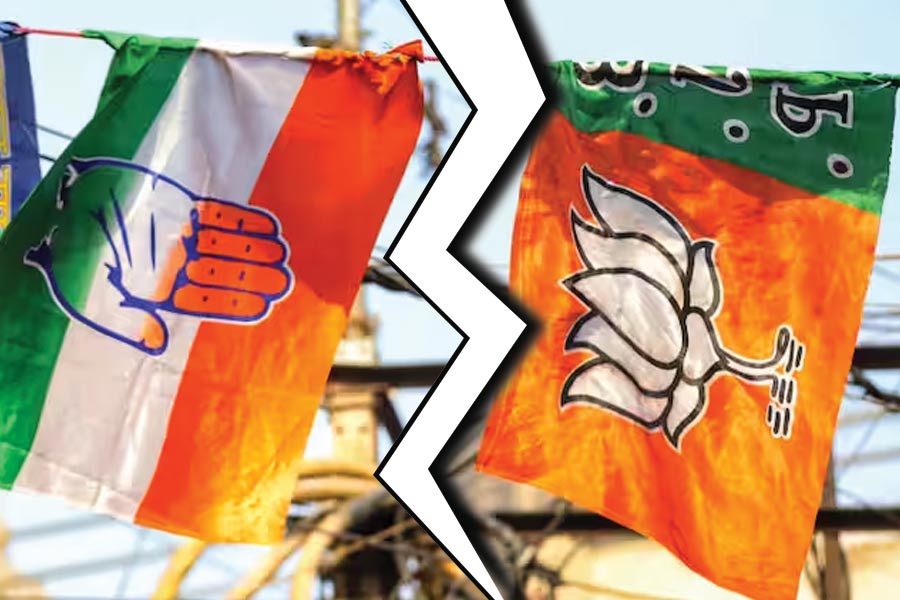

The comment comes even as there has been speculation that the Narendra Modi-government may announce a nation-wide loan waiver. There have also been reports of the newly elected Congress governments in the three states considering a similar loan waiver scheme.

Rajan also made a case for India coming up with a functional out-of-court restructuring process for stressed assets, outside the bankruptcy court, which has been vitiated and stretched by multiple legal challenges.

“The tribunal will be overwhelmed if every stressed firm or project is filed before it. The out-of-court restructuring process requires protecting the ability of bankers to make commercial decisions without subjecting them to inquiry,” Rajan said.

The report stressed on the need to “increase revenues by making the tax system more progressive by bringing more people into the tax net”.