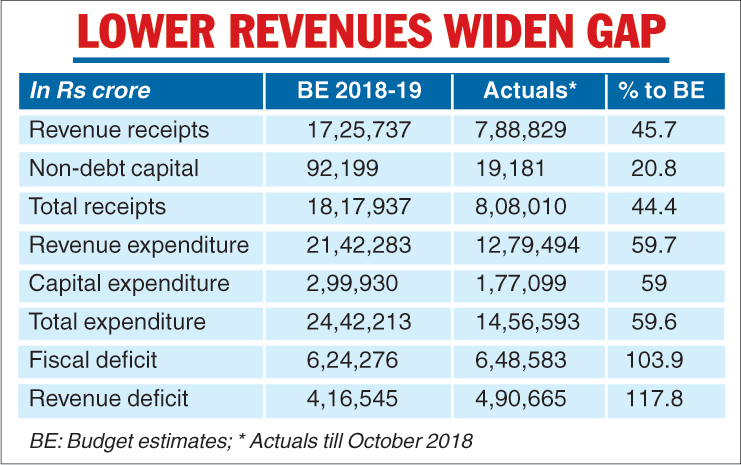

In the first seven months of the current financial year, the government has surpassed the budgeted full-year fiscal deficit target of Rs 6,24,276 crore.

On Friday, the government released its monthly accounts for October which showed that fiscal deficit had touched Rs 6,48,583 crore, or 103.9 per cent of the budgeted target.

In one sense, this leaves finance minister Arun Jaitley’s brave claim that he will be able to cap the fiscal deficit at 3.3 per cent of GDP this year in tatters unless the Narendra Modi government is able to either ramp up its revenues by raiding the RBI coffers and getting the central bank to pay up a special dividend or is able to curtail its spending substantially in the next five months.

The yawning gap needs to be filled — and it hasn’t helped that the government has slashed its borrowing programme by Rs 70,000 crore this year. Borrowings have traditionally covered over 80 per cent of the fiscal deficit.

The government had set its gross borrowing target at Rs 6.06 lakh crore in this year’s budget but now intends to restrict it to Rs 5.35 lakh crore. It raised Rs 2.88 lakh crore by way of borrowings in the first half of the year (April-September) and then said it would raise only Rs 2.47 lakh crore in the second half (October-March).

“The fiscal deficit numbers which do not seem very happy are also illusionary as the government has off-budgeted many spendings such as the bail-out package for IDBI Bank which has come from the LIC and the recapitalisation of state-run banks through bonds,” said M Govinda Rao, former member of the Prime Minister’s Economic Advisory Council.

The only other way to meet the deficit is to relax the fiscal deficit and print more money as advocated by Swadeshi Jagran Manch ideologue S. Gurumurthy whom the central government had nominated on the board of the Reserve Bank of India.

The fiscal deficit which had stood at 96.1 per cent in October last year widened this year as revenue collections, especially mobilisation from the GST, were well below the mark, while government spending had accelerated in the pre-election year, said top finance ministry officials.

According to the latest data, total expenditure for the April-October period stood at Rs 14.5 lakh crore or 59.6 per cent of the full-year target. On the other hand, revenue receipts were 45.7 per cent of the target at Rs 7.88 lakh crore, pushing up the revenue deficit to a high of 117.8 per cent of the budget estimate.

Tax revenue was at Rs 6.6 lakh crore, or 44.7 per cent of the full-year target. Non-tax revenue touched 52.1 per cent of the target at Rs 2.45 lakh crore. Capital expenditure reached 59 per cent of the 2018-19 target compared with 52.6 per cent in the same period last year.

“While expenditure continues to grow, total receipts in October 2018 shrank from October 2017,” said Devendra Kumar Pant, chief economist at India Ratings and Research.

“The extent of a potential fiscal slippage in fiscal year 2018-19 would be driven by the likelihood of meeting the targets for the GST, excise duty, dividends and profits, and disinvestment, and the adequacy of outlays for revised MSPs, the NHPS, fuel and other subsidies,” said Aditi Nayar, principal economist at Icra

Officials said the Modi government is looking at quietly cutting-back on spendings of between Rs 50,000 crore and Rs 70,000 crore to create a fiscal headroom besides trying to earn money through special dividend to manage a difficult fiscal situation.

To try and meet its fiscal deficit target, finance ministry sources said “savings” were expected to be effected in budgeted spending of several social welfare departments, including education, health and rural development and possibly in defence capital spending.

Telegraph infographic