Telegraph infographic

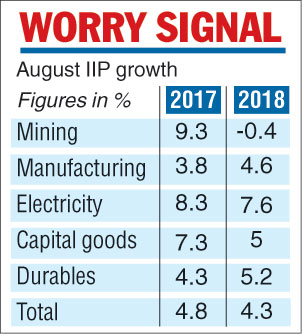

India’s industrial growth slowed down to 4.3 per cent in August against a 6.5 per cent growth in July as rising fuel prices and higher interest rates took their toll on manufacturing, consumer goods and mining sectors.

Spelling double trouble to the economy, inflation inched up 3.77 per cent in September on the back of higher food and fuel prices and a depreciating rupee which made imported goods costlier.

Data released by the government showed manufacturing output increased 4.6 per cent compared with 7 per cent in July and 3.8 per cent in August last year. Consumer durable output rose 5.2 per cent compared with an impressive growth of 14.4 per cent in July. Mining output fell 0.4 per cent year-on-year compared with a 9.3 per cent rise in the same month last year. Output in 16 of the 23 industry groups in the manufacturing sector grew in August, with furniture, wearing apparel and wood and wood products showing the highest growth. On the other hand, printing and the reproduction of recorded media, tobacco products and computer showed the highest decline.

India’s retail inflation which is now taken by central bankers as the deciding factor in targeting inflation through monetary policy measures increased to 3.77 per cent. Retail inflation based on consumer price index had come down to a 10-month low of 3.69 per cent in August. In September 2017, it was at 3.28 per cent.

However, the inflation rate has remained well within the RBI’s target of 4 per cent. In categories such as cereals, meat and fish, eggs, milk products, retail inflation showed an upward trend, data released today showed .

Rucha Ranadive, chief economist, Care Ratings, said: “There has been a marginal increase in food and beverage sector inflation, which has pushed up the CPI, but going forward, we expect that food inflation is likely to moderate, since the kharif output has been good… Going forward, we expect an upside risk to inflation which is persistent on account of higher crude oil prices globally and the rupee's weakness.”