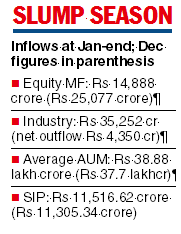

Net inflows into equity mutual funds slumped in January because of volatility in stock markets, data released by the Association of Mutual Funds in India (Amfi) showed on Wednesday.

These schemes saw inflows of Rs 14,888 crore, a fall of 40 per cent from Rs 25,077 crore in the previous month. However, this is the 11th straight month where these schemes are witnessing net infusion. Since March, the segment has seen inflows of over Rs 1 lakh crore. Prior to this, they had consistently witnessed outflows for eight months from July 2020 to February 2021, losing Rs 46,791 crore.

The fall in January has been attributed to volatility in the secondary markets as concerns of the impact of the omicron virus, higher inflation and hawkish actions by various central banks impacted equity prices.

Overall, the mutual fund industry registered a net inflow of Rs 35,252 crore during the period under review compared with a net outflow of Rs 4,350 crore in December.

The average asset under management (AUM) of the industry rose to Rs 38.88 lakh crore at January-end from Rs 37.72 lakh crore at December-end.

Another highlight was the SIP contribution coming in at a record Rs 11,516.62 crore against Rs 11,305.34 crore in the previous month.

Within the equity segment, all categories saw net inflows, though a similar trend was not visible in value funds. The flexi-cap fund category witnessed the highest net inflow to the tune of Rs 2,527 crore, followed by thematic funds at Rs 2,073 crore during the period. On the other hand, the debt segment saw a net infusion of Rs 5,087 crore in January against a net outflow of Rs 49,154 crore in December 2021.

“Retail mutual fund investor confidence in the India growth story has overshadowed the uncertainties arising out of external factors like Fed rate hike or FII outflows.

“The mutual fund asset class has been established as the preferred investment avenue for long term goals-based savings. Retail Investors adopt rotational investment strategy in the event of rate hike and shift their savings to the hybrid category’’, N. S. Venkatesh, chief executive, AMFI, said .

He added that healthier corporate earnings growth will spur further higher quantum of savings into mutual fund industry.