According to the latest reports by AMFI, equity mutual fund inflows jumped to a 12-month high in March 2023. Despite volatility in the markets, this influx shows the continued resilience of investors that seems to have been backed by buoyant SIP inflows.

While those investing in equity are looking to reap the benefits of the rising markets, correcting markets can often leave them in a lurch. At such times, investors may consider allocating a part of their portfolio to hybrid funds.

Usually, hybrid funds have a myriad of misconceptions surrounding them, especially when it comes to their importance and the kind of investor who should be investing in them.

As hybrid funds offer the core benefit of asset allocation, they have the potential to be a notable add-on to an investor’s portfolio to shield him/her from volatility while attempting to meet desired expectations.

Prudent asset allocation

Everyone must have heard of the popular adage ‘Don’t put all your eggs into one basket’ — not to allocate your entire investment corpus to a single scheme or asset class. This may result in the creation of a concentrated portfolio that may not achieve the desired output. This is where the importance of a prudent asset allocation comes into play, making it one of the key differentiating factors in an investor’s portfolio.

We all know that putting money in traditional investment instruments may not be enough to beat inflation. While investors want higher returns, they are also concerned about drawdown risks associated with equities. This is where hybrid funds come into play.

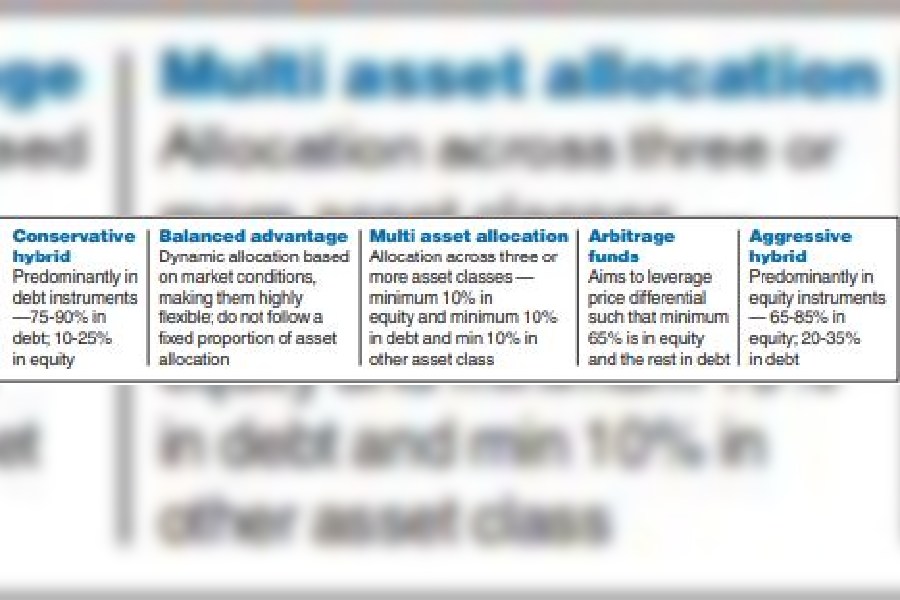

Hybrid mutual funds offer a gamut of options to investors based on their equity/debt exposure (See chart).

Since these funds offer diversification as an inherent component of the scheme, investors are free from the hassle of putting money into multiple funds, proactively tracking them and then, adjusting allocation in response to mark to market changes and incremental flows.

Thus, when an investor invests in a hybrid funds, they avail a ready-made portfolio with a balanced option of risk and potential rewards in just one single fund that is suited to their needs.

Diversification is key

Considering the current macro environment, investors must consider investing in two or more asset classes to be able to potentially beat inflation.

During significantly volatile times, portfolio diversification is one of the most quintessential hedges against inflation.

By ensuring that the portfolio is spread across multiple asset classes or even geographies, investors have the ability to reduce their risk exposure.

Dynamic structure

Investors may consider investing in hybrid funds that dynamically structure themselves to provide exposure to asset classes that are known to withstand (and even potentially deliver returns) under inflationary pressures.

Furthermore, these funds are equipped with an all-weather long-term investing solution that usually has lower downside risk and is relatively less volatile due to their core benefit of diversification, thereby reducing the risk of over-exposure to one asset class.

By diversifying into multiple asset classes that have lower correlation between each other (especially in terms of return variables such as inflation, illiquidity, entrepreneurial risk and manager insights), the potential risk has been spread across them as well. This may ensure that the ability of the portfolio to compound over the long term remains relatively less affected in the face of economic headwinds.

Additionally, investors stand to benefit from periodical rebalancing as the fund manager constantly monitors the fund based on market condition. During volatile market phases that are difficult to navigate, rebalancing the portfolio will be instrumental in keeping the capital protected.

It will realign the portfolio in a manner so as to increase the exposure to underweight assets or reduce exposure to overweight assets, allowing the portfolio to carry the same risk-reward expectations despite external market movements.

In conclusion

Investors must take into account that counting their chickens before they hatch may not provide the desired effect to their portfolio. As retail investors, it is easy to get swayed by every day market news.

However, temporary market upheaval cannot be treated as a benchmark for future returns. When one is investing for the long run, which is a minimum duration of 5 years or more, it is important to understand how certain standard risks can affect the portfolio and make the necessary corrections in one’s strategy to protect it.

The writer is equity fund manager, Axis Mutual Fund

Interest income

I hold a number of term deposits in PNB. While reconciling the bank’s interest and form 26AS for FY 2022-23, I have noticed that the interest income is showing higher by more than Rs 1,23,000 in form 26AS. I have informed the bank. But, if they are unable to rectify the same promptly can you advise me where I should go as this has to be sorted out at the earliest before filing the IT return?

Prabir Kumar Dey, email

You can check if the 26AS data is correlating with AIS based on which the income tax returns are prefilled. If 26AS and AIS are showing the same data, the correction has to be made by the bank and proper certificates issued. You can approach the bank’s grievance redressal cell and keep a record of the complaint if the branch is unable/unwilling to rectify. If you have already filed a return, you may have to file a revised one once the correct data is reflected in 26AS and claim refund if applicable.

Donation certificate

I donated Rs 10,000 to a well known reputed charitable society, registered with the Income Tax department. Although I have made the donation in September 2022 and provided the necessary personal data to enable issuance of certificate, I have not yet received it on the basis of which I may claim exemption. The society has informed that the IT department has not yet opened the portal for issuance of certificates. Can I get it directly from the income tax department?

DM Chakrabarti, email

The CBDT through a circular dated May 24, 2023 has extended the time period for charitable trusts to file form 10BD for FY 2022-23 till 30.6.2023. Only after 10BD has been filed, the trust/society would be able to furnish a certificate of donation in form 10BE from the income tax portal for each respective donor. These forms cannot be created manually and issued to the donor. The donor can then use 10BE to claim deduction under section 80G. You may first check with the charitable society if they have filed 10BD. You may also check the income tax portal which will provide updates when 10BD/BE would be available.