Auto industry body SIAM on Tuesday said there is a need to clarify the scope of 2 per cent “equalisation levy” in the wake of amendments proposed under the Finance Bill 2021, which could impact foreign automobile manufacturers in India.

The levy was originally introduced in 2016 with an eye on taxing transactions arising in a digital economy.

In 2020, its scope was expanded to cover non-resident e-commerce operators.

It was intended to be imposed on payments made to foreign beneficiaries for digital services provided, the Society of Indian Automobile Manufacturers (SIAM) said in a statement.

According to industry players, the Finance Bill 2021 had proposed some modifications to the equalisation levy provisions, which could expand the scope of the levy manifold.

This will potentially make it applicable

not only to e-commerce retailers/marketplace operators, but also traditional brick-and-mortar businesses with a fair degree of digitisation.

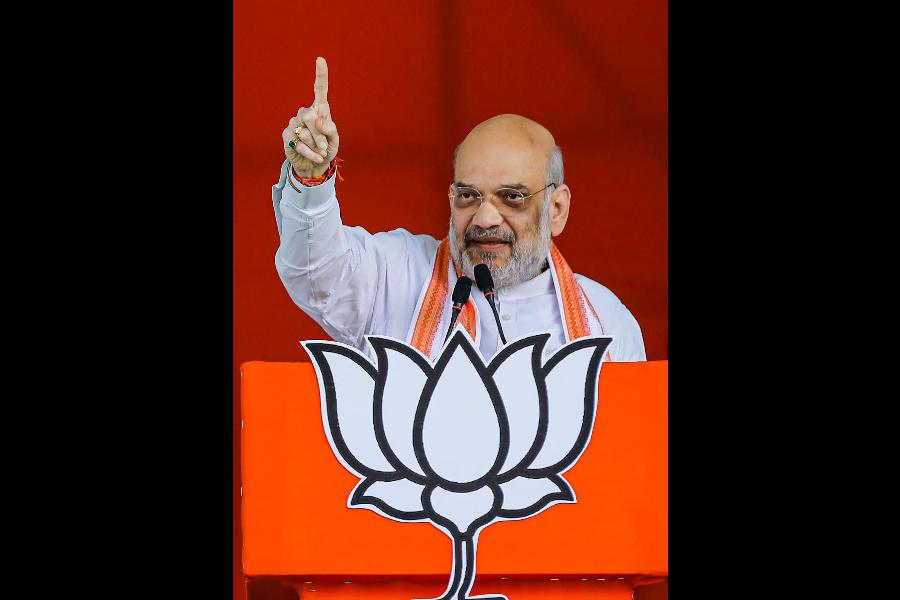

SIAM director-general Rajesh Menon

said, “Digitalisation is used in the auto sector

as a matter of administrative convenience and for increasing efficiencies — not for taking a final commercial decision on sale and purchase.”

He further said actual commercial decisions are offline and done within the overall master agreement in the form of a licence agreement or a joint venture agreement.

“Therefore, internal digital system for supply-chain management should not fall within the provisions of equalisation levy.”

The new system is slated to come into effect from September 1 this year.