Shares of Hyderabad-based Dr Reddy’s Laboratories Ltd (DRL) on Friday dropped close to two per cent on the bourses over reports the US Food and Drugs Administration (US FDA) has issued eight observations on its Duvvada facility, some of which are repeat in nature.

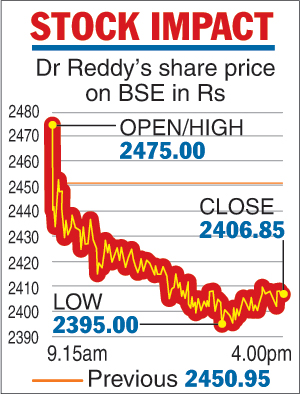

On the BSE, the share settled at Rs 2,406.85, a drop of Rs 44.10, or 1.80 per cent, over the last close. Earlier, the share had dropped 2.28 per cent to an intra-day low of Rs 2,395.

The company had earlier said an audit conducted by the US drug regulator of its formulations manufacturing facility at Duvvada, Visakhapatnam, was completed in late October and it issued a Form 483 with eight observations.

DRL said it was addressing these observations. This came after the company had asked the USFDA to schedule an inspection of the oncology formulation manufacturing facility at the unit.

Telegraph infographic

A Form 483 is issued to a firm at the conclusion of an inspection if investigators observe any conditions that in their judgement may constitute violations of the US Food Drug and Cosmetic (FD&C) Act and related acts. It notifies the company’s management of the objectionable conditions.

According to the USFDA website, at the conclusion of an inspection, the FDA Form 483 is presented and discussed with the company’s management and firms are encouraged to respond to the form in writing with their corrective action plan and then implement that plan expeditiously.

Concerns grew as DRL had received 13 observations for the same facility in March last year. This was preceded by a warning letter in November 2015.

During the second quarter ended September 30, DRL posted revenues of Rs 3,798 crore, which showed a growth of 7 per cent over the same period last year. Net profit came in at Rs 504 crore, which was a rise of 10 per cent on a sequential basis.

The period saw revenues from global generics coming at Rs 3,050 crore which showed a growth of 7 per cent over the year ago period. This was largely driven by contributions from emerging markets and India.