Hyderabad-based Dr Reddy’s Laboratories (DRL) is acquiring a part of the domestic branded business of Wockhardt for Rs 1,850 crore.

DRL will acquire the select divisions of Wockhardt’s branded generics business in India and a few other international territories that include Nepal, Sri Lanka, Bhutan and Maldives.

A statement from the company said the business comprises a portfolio of 62 brands in multiple therapy areas such as respiratory, neurology, dermatology, gastroenterology, pain and vaccines. These businesses would be transferred to DRL along with related sales and marketing teams.

The transaction would also include Wockhardt’s manufacturing plant located in Baddi, Himachal Pradesh with all the employees at the unit. Dr Reddy’s pointed out that the business undertaking is being transferred on a slump sale basis.

As per section 2(42C) of Income-tax Act 1961, “slump sale” means the transfer of one or more undertakings as a result of the sale for a lump sum consideration without values being assigned to the individual assets and liabilities in such sales.

Wockhardt will now seekshareholders’ approval for the sale through a postal ballot.

“India is an important market for us and this acquisition will help in considerably scaling-up our domestic business. The acquired portfolio shall enhance Dr Reddy,” presence in the high growth therapy areas with market leading brands such as Practin, Zedex, Bro-zedex, Tryptomer and Biovac. We believe the portfolio holds a lot of potential and will get an impetus under Dr Reddy’s,” G.V. Prasad, co-chairman and managing director of DRL, said while commenting on the transaction with Wockhardt.

The deal is expected to be closed in the first quarter of the financial year 2020-21.

Revenue watch

According to Wockhardt, the business being transferred reported revenue from operation of around Rs 377 crore which is close to 15 per cent of the consolidated revenues for the nine months period ended December, 31 2019.

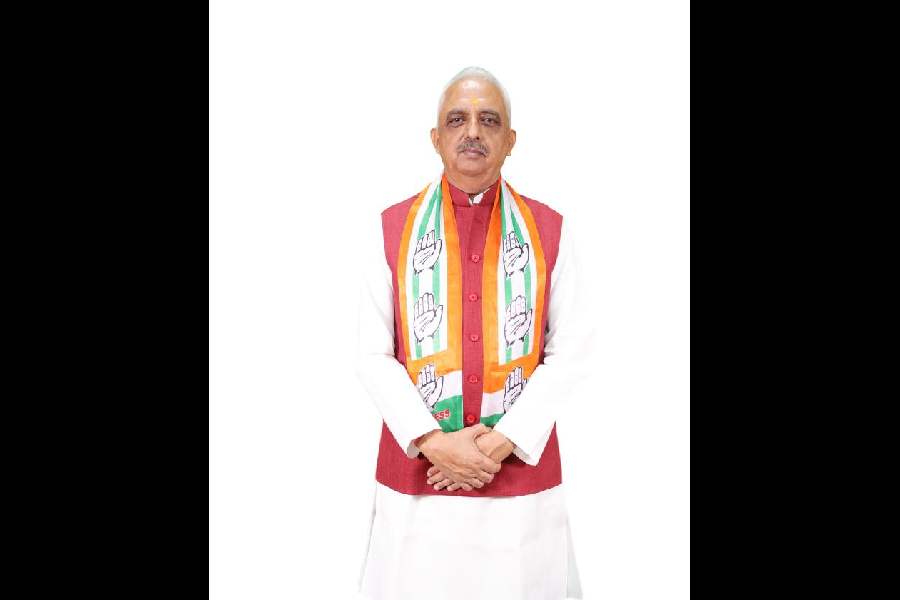

“The intended sale of business portfolio is in line with the company's strategic plan to shift from acute therapeutic areas to more chronic business like anti-diabetes, CNS and also to its niche antibiotic portfolio of new chemical entities (NCEs),” Habil Khorakiwala, founder chairman, Wockhardt Group, said.

After the sale of the select business, Wockhardt said it would continue to own all international operations in the UK, US, Ireland and other locations through its step-down subsidiaries. The formulation plants located at Waluj, Shendra and Chikalthana in Aurangabad, Bhimpore and Kadaiya in Daman; bulk drugs plant at Ankleshwar and manufacturing facilities at all existing international locations would also continue to be owned by the company.

The company said its research and development centers located at Chikalthana, Aurangabad, and existing facilities in the international locations would also continue to be under its fold along with a significant part of domestic branded business constituting chronic and speciality portfolios.