For in the dew of little things the heart finds its morning and is refreshed

The above quote, attributed to Lebanese poet-philosopher Khalil Gibran, captures the essence of what investors must have experienced in recent days — a firm nudge towards small caps. Indeed, the small cap world is all astir, thanks to the new found interest exhibited in its favour by an influential section of the market.

At least two small cap funds have been lined up already to capitalise on the trend. The situation, however, begets a simple question: Are small caps worth the effort at this juncture? Or, are there perils waiting for investors who plunge headlong into them? Today, we will find out whether, in the current circumstances, such allocations make sense.

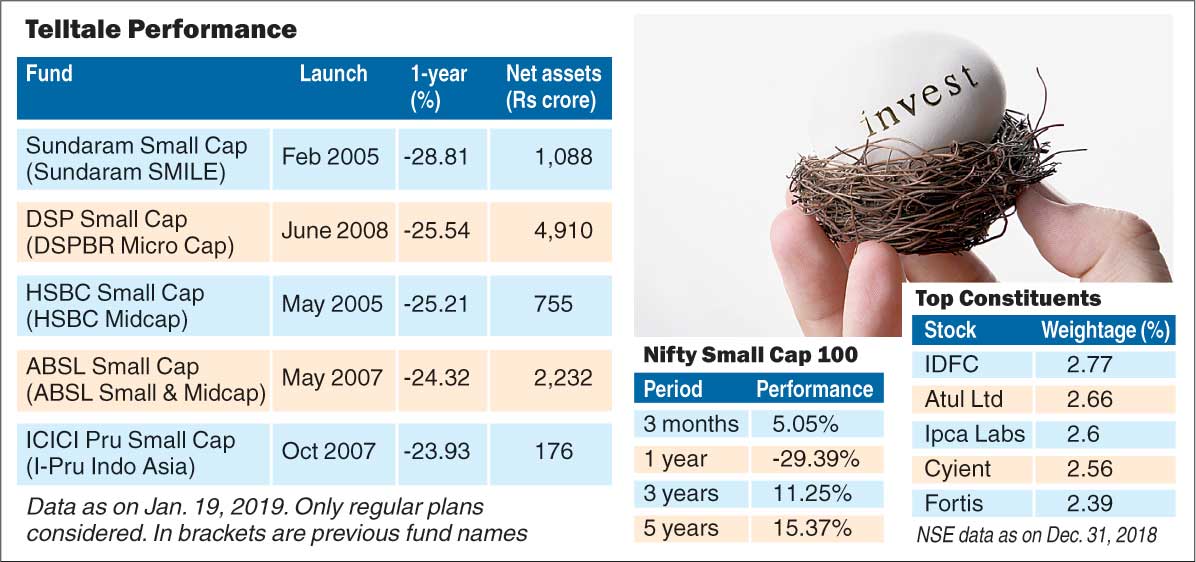

(Telegraph info-graphic)

Fresh opportunities

First, a bit of rational thinking, beginning with the premise that small caps are essentially under-researched. Indeed, many constituents of the small cap indices are not actively covered by analysts; and such a scenario underscores the presence of virgin domains replete with stock-picking opportunities.

According to one estimate, as much as a fourth of BSE-listed small cap stocks are just barely covered, while about 300 of these are covered by fewer than 10 analysts. This creates scope for identifying fresh cases for professional investors such as fund managers.

Added to this is the strong feeling that well-chosen small cap stocks (despite the under-performance that has generally troubled their universe) are agile enough to create wealth for investors, and, over a long period of time, many of them are capable of beating their large-cap counterparts which have otherwise proved their mettle across market cycles.

Case in favour

Let us now explore the other reasons why small caps are being touted.

- Recent attempts by Sebi to rationalise funds and re-categorise them has diminished the domain for large and mid caps. The number of stocks that can be found suitable for inclusion in these categories is somewhat restricted than what was earlier.

- It is believed that about 2,500 stocks are available for inclusion in the small cap group. These actually encompass quite a wide range of economic segments. A decent small cap portfolio can, therefore, can potentially end up as a very diversified collection of stocks.

Such factors have given rise to the belief that discerning investors can identify under-researched small caps early on and generate sufficient value.

And the case against

While small cap indices have remained depressed in recent times, recent under-performance cannot be a perfect argument for investments. “Today’s small will be tomorrow’s big” is not necessarily a rationale that clicks every time. Thus, investors keen on small caps need to consider factors that are likely to act as dampeners too. Here are a few points to ponder.

- These are not for the risk-averse players. On the contrary, small caps should be ideally recommended only for those who can take risk in an aggressive manner.

- Time (not timing) is crucial — one should be willing to stay invested in high-conviction small caps for reasonable periods of time. At least 5-7 years can be considered reasonable in the current circumstances. Naturally, there can be no guarantees.

- Illiquidity may be a constraining factor. What if some of the chosen small caps, despite apparent positives, continue to suffer from this ailment?

Gradual build-up

Conservative investors would do well if they go for a strategic step-by-step build-up of a decent small cap portfolio. A head-on, bulk investment need not be done right away. Investors who do not have the time to do this in a meaningful manner should be willing to approach professional entities, that is asset management companies. They need to pick up one or more small cap funds that invest in high-quality businesses with robust earnings. These funds will acquire reliable stocks with robust growth prospects.

The following strategy can be a good fit in this case:

- Select a fund house that offers a small cap fund. Make a one-time investment in a liquid fund (or an ultra-short term fund) managed by it.

- Choose a trigger that will allow equal amounts to be shifted from the liquid fund to the small cap fund, based on market declines. Complete the process over, say, six months.

- Let’s say the trigger works perfectly — so an allocation is made every time a decline occurs. The latter can be determined if the small cap benchmark index drops by a certain margin.

- Let’s say the trigger does not work well. In this case, a designated day can be utilised to pursue a similar switch strategy. For the sake of convenience, such a designated day can be the last Friday of a month or the day preceding it if Friday is a holiday.

Besides these, investors should consider a few standard factors. They need not, for instance, keep their money locked in closed-end small cap funds. Only open-ended funds, which allow them to exit at applicable NAV, should be chosen. However, they should still be prepared to stay put for a decent stretch of time to fully leverage on their growth prospects.

Investors should not make small caps part of their core holdings. Instead, large and medium cap funds should be accorded a clear priority. Small caps can only act as kickers — an additional diversifier on the basis of market capitalisation. Multi-cap funds, which would have a sprinkling of small cap stocks in addition to large and medium caps, can also be a viable entry point for new investors. Such funds will ensure automatic diversification, a common goal for investors, large and small. Systematic investment plans in these funds can help them build their capital over the long term.

The writer is director, Wishlist Capital Advisors