HDFC Bank has posted a 17.7 per cent rise in net profit for March quarter of 2020. However, the bottomline came in a tad below estimates as provisions jumped because of the Covid-19 outbreak.

The private sector bank’s net profit came in at Rs 6,928 crore, an increase of 17.7 per cent over Rs 5,885 crore in the quarter ended March 31, 2019. Analysts had expected the lender to record a net profit of over Rs 7,000 crore.

A key highlight of the quarter was the rise in provisions and it included an contingency amount of Rs 1,500 crore specifically for coronavirus.

The bank said that in line with the Reserve Bank of India (RBI) guidelines on the Covid-19 regulatory package, it would be granting a moratorium of three months on the payment of all instalments that are due between March 1, 2020, and May 31, 2020, to all eligible borrowers classified as standard, even if overdue, as on February 29, 2020.

The lender said that for all such accounts where the moratorium is granted, the asset classification shall remain at standstill during the moratorium period.

For the quarter under review, provisions and contingencies stood at Rs 3,784.5 crore against Rs 1,889.2 crore for the quarter ended March 31, 2019.

HDFC Bank said that during the quarter, there was a considerable slowdown in economic activities following the outbreak of Covid-19. Moreover, the lockdown in the latter half of March had an adverse impact on business volumes in terms of loan originations, distribution of third-party products and payments product activities. The bank also could not optimise its collection efforts as a result of which its fees and other income were lower by Rs 450 crore.

During the period, the lender’s net interest income (interest earned minus interest paid) grew to Rs 15,204 crore from Rs 13,090 crore in the same period of the previous year.

However, its asset quality improved on a sequential basis. The gross non-performing assets were at 1.26 per cent of the gross advances as on March 31, 2020, against 1.42 per cent as on December 31, 2019, and 1.36 per cent as on March 31, 2019.

In line with the RBI directions on Friday, the board of directors of HDFC Bank did not declare any final dividend for the year ended March 31, 2020.

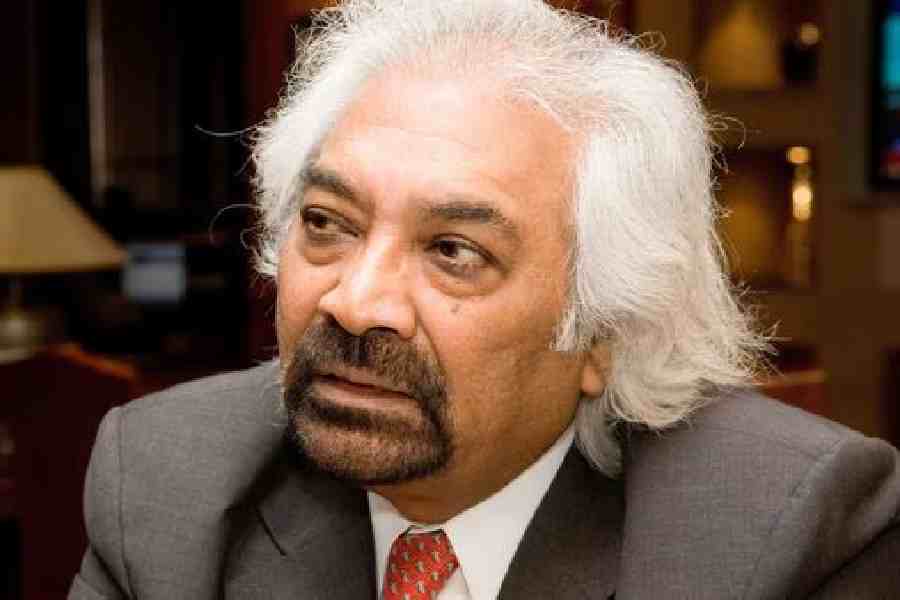

Successor shortlist

HDFC Bank said its board has shortlisted three candidates who will succeed Aditya Puri as the managing director and CEO of the bank.

“The bank will be submitting its application to the RBI with the names of the candidates in the order of preference, seeking approval for the appointment of the new managing director and CEO, who shall succeed Aditya Puri,” the lender said.

Puri’s term is set to expire on October 26.

HDFC Bank also disclosed that Sashidhar Jagdishan and Bhavesh Zaveri on Saturday tendered their resignations as additional directors. This comes after the RBI had asked the lender to review their appointment as it can be done only after a new CEO assumes charge.

In November 28, 2019, HDFC Bank had informed the bourses about the appointment of Jagdishan as additional director and Zaveri as the executive director (wholetime director) of the bank, subject to the approval of the RBI.