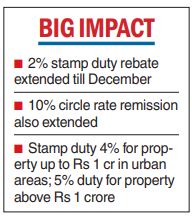

Bengal has decided to extend the 2 per cent rebate on stamp duty and 10 per cent remission on the circle rate for another quarter, continuing its support to the real estate industry in the state.

The decision for yet another extension — from September 30 to December 31 — was notified by the Mamata Banerjee-government on Wednesday ahead of the Durga Puja.

In Bengal, the stamp duty stands at 4 per cent in urban areas for property up to Rs 1 crore and 5 per cent for property above Rs 1 crore. In rural areas, the duty is 3 per cent for property up to Rs 1 crore and 4 per cent above Rs 1 crore. A finance department notification issued on Wednesday read “..in the interest of public service and also considering the interest of the home buyers who have suffered extremely due to Covid-19 pandemic, it has been decided by the government in the finance department to further extend the benefits..”

The rebate on stamp duty and the circle rate — the government notified rate considered for calculating stamp duty and registration fee — has so far had desired results for the home buyers, real estate industry as well as government revenue.

Since the announcement in July 2021, the Calcutta Metropolitan Area, the biggest realty market in Bengal, alone recorded registration of 57,136 residential properties till August 2022, a report by Knight Frank revealed. Last month was the third highest in terms of registrations.

A Motilal Oswal report said the buoyancy in the market translated into a 33 per cent rise in revenue collection by Bengal from this head in the last fiscal. The state earned Rs 7,366.4 crore on this head, the highest ever from this source, compared with Rs 5,527 crore in FY21. The multiple extensions have now emboldened the industry to seek permanent cuts.

“We request the state to reduce stamp duty by 2 per cent permanently,” Sushil Mohta, president of Credai West Bengal, said. Nandu Belani, president of Credai Bengal, said the reduction will be helpful to buyers opting for under-construction properties, which also attract GST, apart from stamp duty.