State-owned Bengal Chemicals and Pharmaceuticals plans to report a positive net worth by 2021.

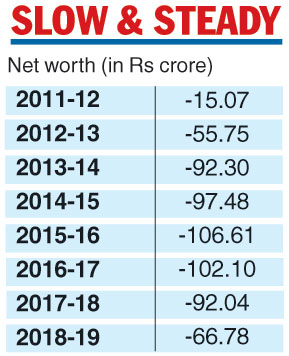

The city-based firm, which has posted three consecutive years of profit in the last three financial years, ended 2018-19 with a negative net worth of Rs 67 crore.

Managing director P.M. Chandraiah said two consecutive years of profit in 2019-20 and 2021-22 along with the repayment of borrowings worth around Rs 200 crore will help improve the balance sheet of the firm that found its way to the BIFR in 1992 after it was taken over by the government in 1977.

The iconic pharma company was founded in 1901 by Acharya Prafulla Chandra Ray.

“Bengal Chemicals has seen a turnaround. The company posted profits of Rs 4.51 crore, Rs 10.06 crore and Rs 25.26 crore, respectively, in the past three years. There has been a significant improvement in the net worth as well of around Rs 40 crore since 2015-16. Going forward, our plan is to be a positive net worth organisation by 2021 and a debt-free company by 2022,” Chandraiah said at the earnings meet of the company on Tuesday.

The Telegraph

The company has also brought down its borrowing to Rs 200 crore and repaid high-interest bank loans which lowered the finance costs during 2018-19. It has sought a waiver of interest of around Rs 85 crore against a loan taken from the central government.

“We would aspire to be a miniratna company by 2023 and achieve a business of Rs 500 crore by 2025. Much of the growth is expected to come from the existing line of business in the pharmaceuticals and home products categories,” said Chandraiah.

“For the past five years, we have been growing at a compounded annual growth rate (CAGR) of 27 per cent and if we are able to maintain a CAGR of 20-25 per cent for the next few years, we can achieve sales of Rs 500 crore,” he added. The company recorded a turnover of Rs 120 crore in 2018-19.

The company is also looking to widen its distribution channels. Having tied up with e-commerce platform Big Basket, the company has initiated discussions with retailers such as Spencer’s and Big Bazaar to sell its products.