The board of Bandhan Bank has approved the proposal to increase the shareholding limits for foreign portfolio investors and foreign institutional investors from 24 per cent to 49 per cent of the paid-up capital of the bank.

The move comes at a time the bank is looking to lower its promoter holding and comply with the licensing regulations of the RBI.

“The proposal has been approved by the board to have sufficient headroom for FIl and FPI holding so that promoter Bandhan Financial Holdings’ stake can be diluted from 60.96 per cent to 40 per cent to comply with the guidelines for licensing of new banks in the private sector read with the licensing conditions for the bank.

“The board has also recommended the proposal to the shareholders of the bank for approval by a special resolution through postal ballot,” the bank said in a regulatory filing to the bourses on Thursday.

In the September quarter, institutional holding in the bank was at 15.75 per cent. This includes Singapore’s GIC affiliate Caladium Investment’s holding of 4.58 per cent, International Finance Corporation’s 1.77 per cent. FPIs held 6.91 per cent.

The merger with Gruh Finance has helped cut promoter holding to 60.96 per cent from 82 per cent earlier.

The bank on Thursday posted a consolidated net profit of Rs 972 crore for the July-September quarter, up 99.18 per cent over the year-ago period. This includes Gruh Finance’s numbers.

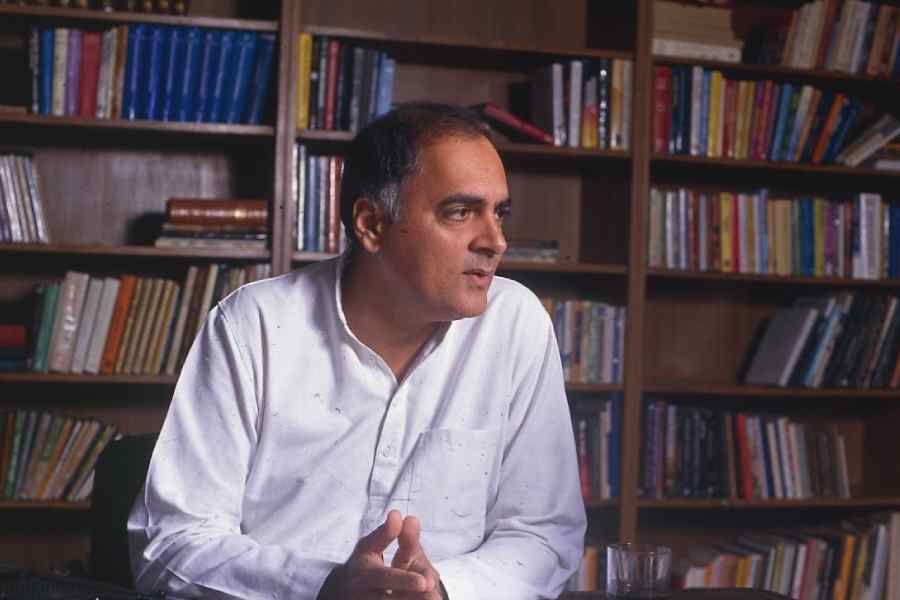

“There has been a strong growth in deposits and advances with a record growth in profit. Having completed the merger (of Gruh), we now look forward to enhancing the housing loan business,” said MD and CEO Chandra Shekhar Ghosh.