The country would be keeping a close watch on the two-day meeting of oil producing cartel Opec starting Thursday as any production cut could ramp up global crude prices, with adverse consequences for the economy ranging from a higher import bill and a surge in current account deficit.

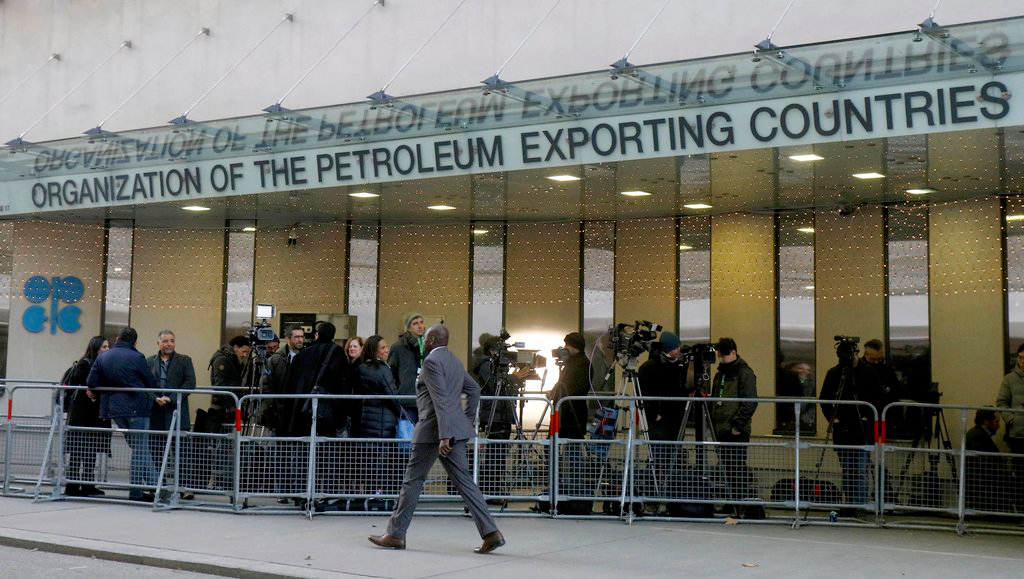

The Opec meet in Vienna comes days after Qatar decided to exit the cartel from January amid growing demand from member countries to cut output and raise prices. “We would be closely monitoring the Opec meeting as it would have economic implications for the country. Any move to cut the output could result in global crude prices going up and it would impact our oil import bill,” a senior oil ministry official said.

A spike in crude price would add to the concerns of the government, while a fall in prices would provide an opportunity to raise revenue through higher excise duties.

Saudi Arabia is reportedly is pushing for a supply cut of 1-1.4 million barrels per day to shore up prices.

The S&P Global Platts Analytics predicts a 1.2 million-1.4 million barrel per day reduction from October levels, when prices had climbed to a high of over $86 per barrel. The benchmark British crude brent is trading around $61.74 per barrel and WTI (US) about $52.95 per barrel.

Since India is a major importer of crude — close to 80 per cent of its requirement is met through imports — any jump in prices would affect its fiscal deficit.

An increase of a dollar in oil price jacks up the country’s import bill by Rs 6,158 crore and the variation in exchange rate by a rupee changes oil import by Rs 6,639 crore.

Analysts, however, said the exit of Qatar from Opec would have little impact in altering crude prices. Global energy research firm Wood Mackenzie, said: “Qatar is Opec’s smallest Middle East oil producer, and the group’s fifth smallest producer overall. Its total 2018 oil production is estimated at 600,000-650,000 barrels per day, less than 2 per cent of Opec’s oil output.”

The research firm said “Qatar’s Opec exit underlines the country’s aim to maintain its place in the global LNG market”. Increased gas production by Qatar, however, should provide an opportunity for India to tap the potential to meet its growing demand. Rating agency Icra has forecast current account deficit to come at around 3 per cent of GDP because of the high oil import bill.

Aditi Nayar, principal economist with ICRA said the current account deficit to widen sharply to $19-21 billion or 3.0 per cent of GDP in Q2 FY2019, from the modest $7 billion in Q2 FY2018, led by higher crude oil prices and gold imports. Following the YoY surge in crude oil prices, India’s net import bill related to petroleum, crude and products increased by a sharp 60 per cent to $23 billion in Q2 FY2019 from $14 billion in Q2 FY2018.

“The recent correction in crude oil prices has doused concerns regarding the size of India’s current account deficit in H2 FY2019. Moreover, a seasonal uptrend in exports should help moderate the current account deficit in H2 FY2019 relative to H1 FY2019. Nevertheless, the current account deficit is forecast by ICRA to widen to $68-73 billion (2.6% of GDP) in FY2019 from $48.7 billion in FY2018 (1.9% of GDP), if the price of the Indian basket of crude oil averages at $72/barrel in FY2019,” Nayar added.