From renovating your kitchen and upgrading your bedroom to enhancing the overall aesthetics of your home — a home improvement project often requires a substantial financial commitment. Could a personal loan come in handy in such situations? In this blog, we will explore if a home improvement loan is a feasible solution. Read on!

What is an Instant Personal Loan?

Instant personal loans have gained popularity due to their accessibility and swift approval processes. It is an unsecured financial product that provides quick access to funds without the need for collateral. Offered by various banks or NBFCs, it involves a simplified application process, typically requiring minimal documentation. The approval is swift, and funds are disbursed rapidly, making it an ideal solution for urgent financial needs. Borrowers can utilise the loan amount for various purposes, such as home improvement, medical expenses, or debt consolidation.

Apply for an Instant Personal Loan in 3 Easy Steps

You can apply for an Instant Personal Loan in 3 easy steps:

- Step 1: Click on the ‘Apply Now’ button.

- Step 2: Fill in the loan application form with the required details.

- Step 3: Upload necessary documents.

Upon successful verification, the loan amount will instantly be disbursed into your bank account.

5 Benefits of Using Instant Personal Loan for Home Improvement

1. Higher Loan Amount

Home improvement is a long-term investment. Avail yourself of a higher loan amount and renovate your home to make your abode a true reflection of your personality.

2. Quick Approval and Disbursement

Instant personal loans are an attractive option if you need urgent cash for home improvement. Funds are often disbursed swiftly, enabling homeowners to commence their projects without delay.

3. Flexibility in Usage

One of the advantages of an Instant Personal Loan is its flexibility in usage. It allows homeowners the freedom to allocate funds towards specific areas of the home that require improvement, whether it's remodelling, repairs, or cosmetic enhancements.

4. Minimal Documentation

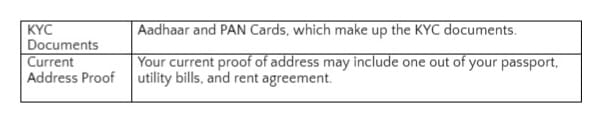

Getting an instant personal loan requires just a few documents such as KYC documents – PAN Card and Aadhaar Card, and your current address proof – passport, utility bills, or rental agreement.

5. No Collateral

Home improvement loans may require collateral but instant personal loans are unsecured.

Documents Required

The list of required documents:

Note: The above-mentioned are some commonly required documents; they can vary across lenders.

Making an Informed Decision

Project Cost Analysis

Conduct a detailed assessment of your home improvement project's overall cost. Ensure the loan amount obtained through an instant personal loan covers the expenses required to complete the project.

Financial Preparedness

Evaluate your current financial situation and repayment capacity. Determine whether the monthly loan repayment fits comfortably within your budget without straining your finances.

To Conclude

While an instant personal loan offers swift access to funds for home improvement projects, its suitability depends on various factors. Consider the loan's interest rates, repayment terms, and your financial preparedness before opting for this financing avenue. Assessing these aspects ensures that leveraging an instant personal loan aligns with your requirements and allows you to transform your home without compromising your financial stability.

Disclaimer: This is a sponsored article and does not involve any editorial input. The views expressed, including any statements, views, opinions, announcements, declarations, or affirmations are neither supported, nor endorsed by The Telegraph Online.