Fixed deposits (FDs) have become a mainstay of financial planning, offering guaranteed returns over set periods. AU Small Finance Bank meets a variety of financial needs, providing investment products and credit solutions. The bank provides FDs at attractive rates to senior citizens and non-senior citizens, providing potential returns.

For risk-averse investors, fixed deposits are a reliable choice for parking surplus funds and wealth creation. With issuers like AU Small Finance Bank, efficient investing starts with a range of FD options, such as regular FDs and tax-saver FDs. The latter allows investors to claim tax deductions of up to ₹1.50 Lakhs per financial year u/s 80C of the Income Tax Act, 1961.

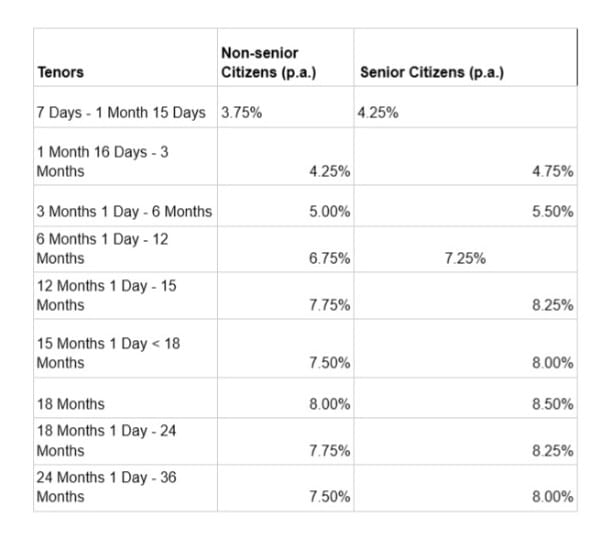

AU Small Finance Bank FD Interest Rates

Here’s an overview of the AU Small Finance Bank FD Rates:

Disclaimer: These interest rates are accurate as of 24th January 2024, and are subject to change.

AU Small Finance Bank goes beyond just choices, adding perks to enhance your FD experience:

- Competitive Rates

Enjoy some of the market's highest interest rates, especially for longer tenors.

- Senior Citizen Benefit

Senior citizens get an extra 0.50% p.a. on their FD interest. AU Small Finance Bank recognises their contribution and ensures their golden years shine brighter.

- Loan Against FD

Borrow against your FD while your interest keeps accruing. It's like having a financial safety net woven into your investment.

- Convenient Access

Open your FD online, through the app/net banking, or visit a branch. Effortless investing puts the power of financial growth in your hands.

- Customisation Facility

AU Small Finance Bank offers flexible interest payouts, nomination facilities, and even premature withdrawal options, subject to penalty charges.

Eligibility and Documents Required

To apply for an AU Small Finance Bank Fixed Deposit, ensure you meet the eligibility criteria:

- Age: Above 18 years

- Residency: Indian citizen, NRI, or member of Hindu Undivided Family

- Entity: Partnership firm, sole proprietorship firm, limited company, or trust

Once eligible, apply online with minimal KYC documentation. Required documents include:

- Proof of identity: Aadhaar card, PAN card, Driving license, Voter ID, or Passport

- Proof of address: Aadhaar card or Passport

- Latest passport-size photograph

Conclusion

These FDs are more than just financial tools; they're seeds for a secure future. Whether it's retirement planning, your child's education, or that dream vacation, AU Small Finance Bank has an FD that helps your goals blossom.

In conclusion, AU Small Finance Bank emerges as a robust choice for individuals seeking secure and rewarding fixed deposit options. The bank's competitive FD interest rates, flexible tenors, and diverse offerings cater to various financial goals.

Certain added advantages include the convenience of online FD opening, a senior citizen interest rate boost, and the option to take a loan against FD. This demonstrates a commitment to enhancing the overall FD experience for customers.

Disclaimer: This is a sponsored article and does not involve any editorial input. The views expressed, including any statements, views, opinions, announcements, declarations, or affirmations are neither supported, nor endorsed by The Telegraph Online.